Power the winning trio with mortgage tech

Uncover the key to the mutually beneficial loan officer, borrower, and real estate agent relationship: Your mortgage technology.

Start learning about Power the winning trio with mortgage tech

Deliver seamless digital journeys from application to close.

Offer unified experience across lines of business.

A single platform powering our products

Elevate the experience of your members

Streamline your lending processes

Optimize workflows and improve lender partnerships

Bring best-in-class home lending experience

Reshaping the way we bank

All press is good press

Powering the future of banking

Better partners for better banking

Join us build something big

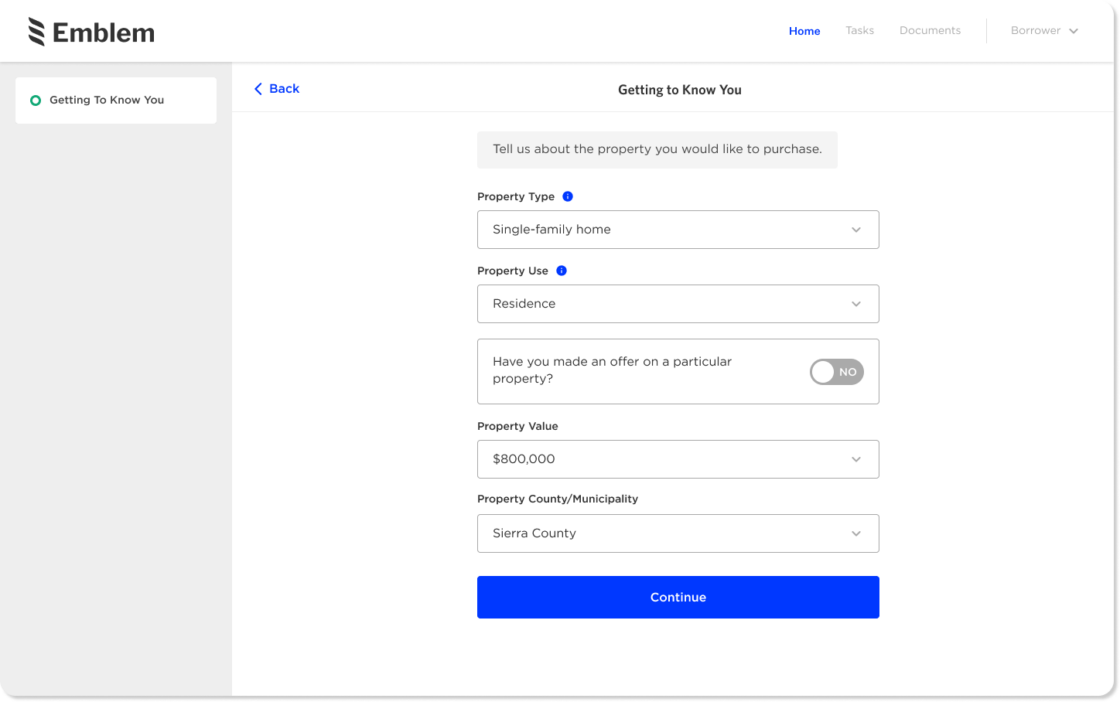

Create a home loan process to reach a wider borrower audience from pre-application to close.

With features that enable customers to feel understood, your borrowers will know they're in the right hands.

Provide an easy and intuitive application process through a borrower loan app with educational, dynamic questioning and self-serve capabilities.

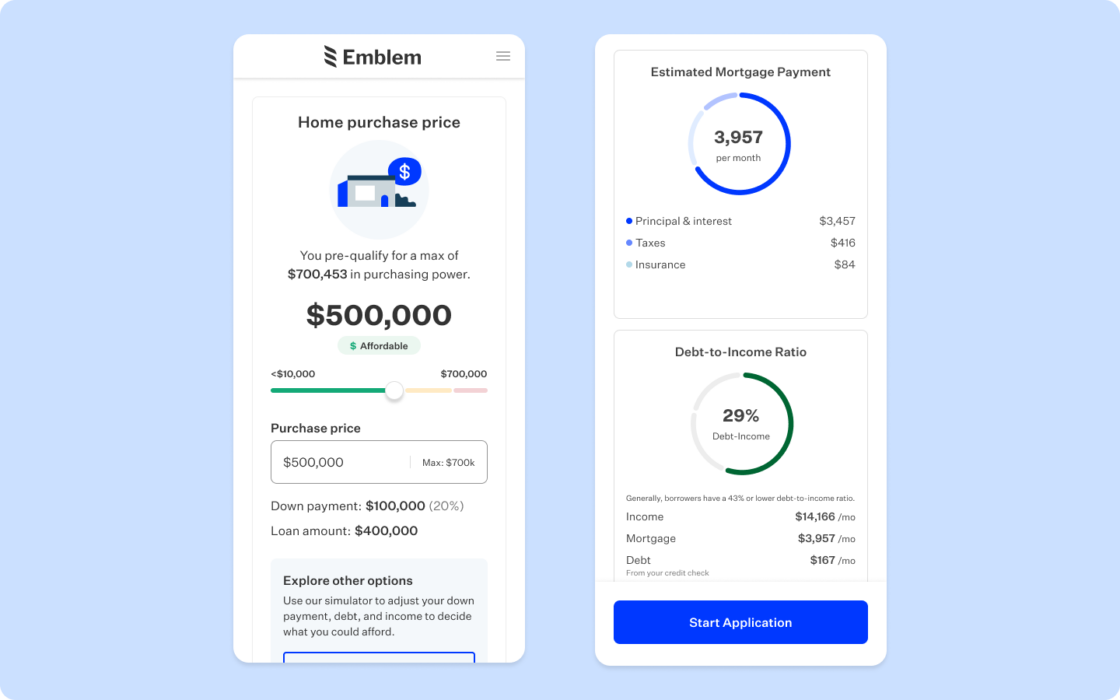

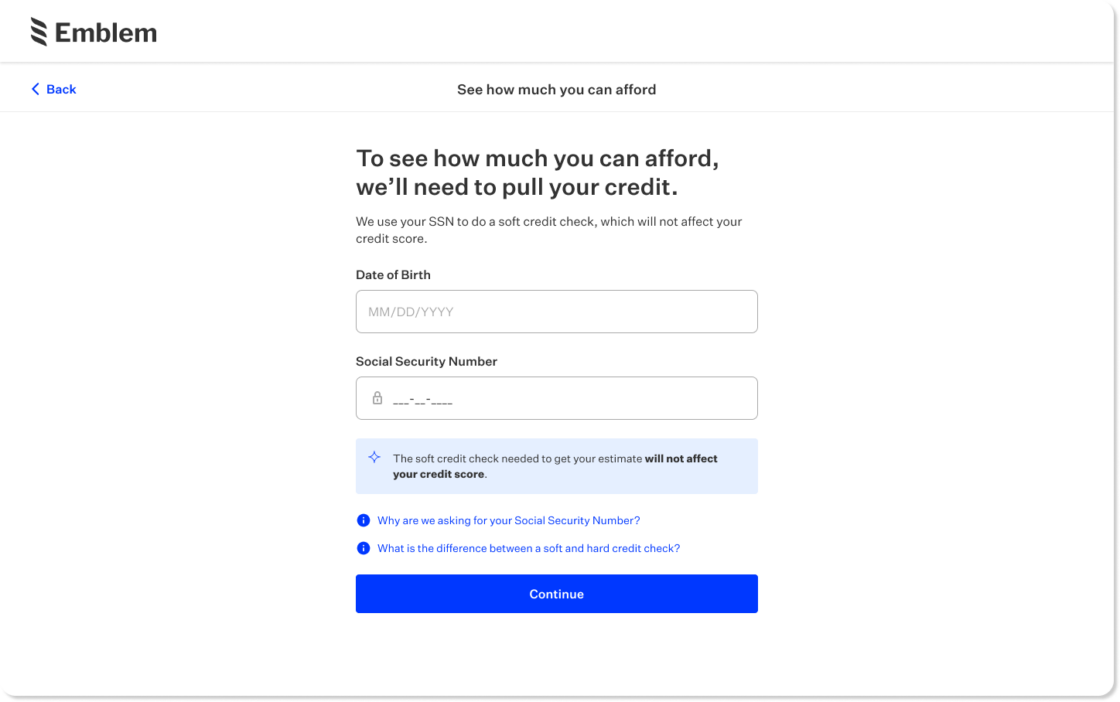

Establish trust and qualify leads even before application with our loan scenario simulator and soft credit pulls.

Stay on top of outstanding tasks and identify up to 65% of conditions upfront with triggered, automated follow-up notifications.

Give borrowers a great first impression with a soft credit pre-qualification that reduces friction, cuts costs, and protects them from tri-merge solicitation.

Lead borrowers through any challenge during the mortgage process with real-time assistance from anywhere at any time.

Improve engagement, pull-through, and speed to close with real-time communications.

Drive conversions by engaging borrowers at the top of the funnel with instant rate quotes.

Conveniently deliver digital disclosure packages to borrowers throughout the process in a single platform.

Having a singular, device-agnostic home-lending platform is of paramount value for us.

Jay Romanovsky

Director of IT Systems, Affinity Federal Credit Union

170%

YTD net income total of mortgage division compared to budgeted value

8 days

time reduced from manufacturing cycle within 6 months of implementation

80 loans

active pipeline volume handled by processors with Blend

The time savings through origination, processing, and underwriting has allowed us the opportunity to serve more members, capture more business, and streamline our process.

Julio Rios

Vice President of Mortgage Lending, University Wisconsin Credit Union

33%

increase in loan volume above market growth rate

12 days

decrease in loan cycles

$2866

ROI from Blend per loan

Meeting customer expectations is a key component of staying competitive in the industry — and the importance of agility in regards to our strategy can’t be overstated.

Kyra Kent

SVP, Director of Digital Origination Strategy, BOK Financial

72%

of the cost of an in-house build

25%

of small business checking and savings volume for the bank

50%

accounts created from new customers

Subscribe to get Blend news, customer stories, events, and industry insights.

Uncover the key to the mutually beneficial loan officer, borrower, and real estate agent relationship: Your mortgage technology.

Start learning about Power the winning trio with mortgage tech

In this Mortgage Power Up, Atlantic Coast Mortgage’s CIO, Ed Vint, shares how Blend’s platform helps them realize opportunities across four key areas that other providers were unable to match.

Read the article about How Atlantic Coast Mortgage uses Blend to deliver a frictionless borrower experience

Learn how Atlantic Coast Mortgage partnered with Blend for a secure, innovative, borrower-first solution after months of searching for a new platform.

Watch video about Mortgage Power Up: Deliver a secure, frictionless borrower experience on-demand

Sign up for a personalized demo and get started in 4 weeks or less