Shifting home equity into self-driving mode

We've dismantled the current home equity process. Learn more about our powerful and unique new solution.

Read the article about Shifting home equity into self-driving mode

Deliver seamless digital journeys from application to close.

Offer unified experience across lines of business.

A single platform powering our products

Elevate the experience of your members

Streamline your lending processes

Optimize workflows and improve lender partnerships

Bring best-in-class home lending experience

Reshaping the way we bank

All press is good press

Powering the future of banking

Better partners for better banking

Join us build something big

Shift the focus from processing paperwork to empowering homeowners with expert guidance, leading them towards informed borrowing decisions and the right home lending solutions.

Guided origination for digital and physical service touch points that ushers applications through intent, offer, and closing.

Leverage real-time data verification for income, employment, and identity, reducing follow-up tasks and preventing approval reversals.

End-to-end integration of native and third-party services reduces manual effort and prevents costly delays.

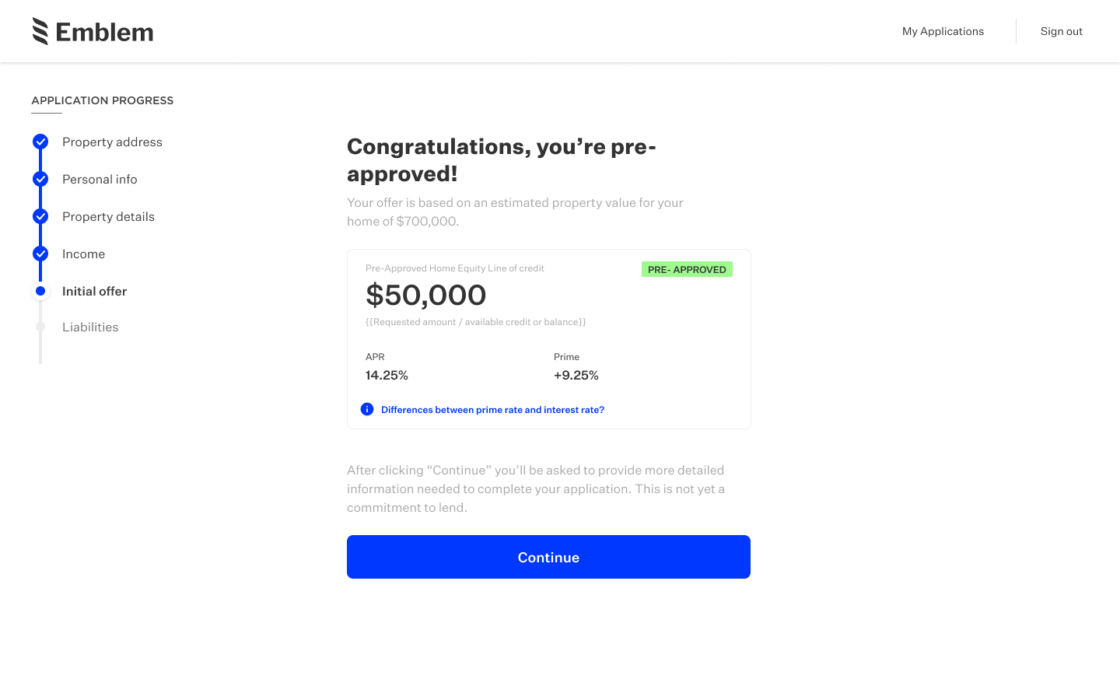

Utilize Blend’s native decision engine to render credit and pricing decisions, generating pre-qualified offers early in the process and surfacing firm offers in under a second.

Provide end-to-end digital experience options with fully supported digital closing, a digital signing room, and services for Remote Online Notary.

Verify property details and flood zone determination before making commitments to approve, and accelerate closings by automating title orders.

Approve more loans, faster by capturing debt consolidations details up front

Integrate automated valuation models to generate equity estimates and provide homeowners with feedback.

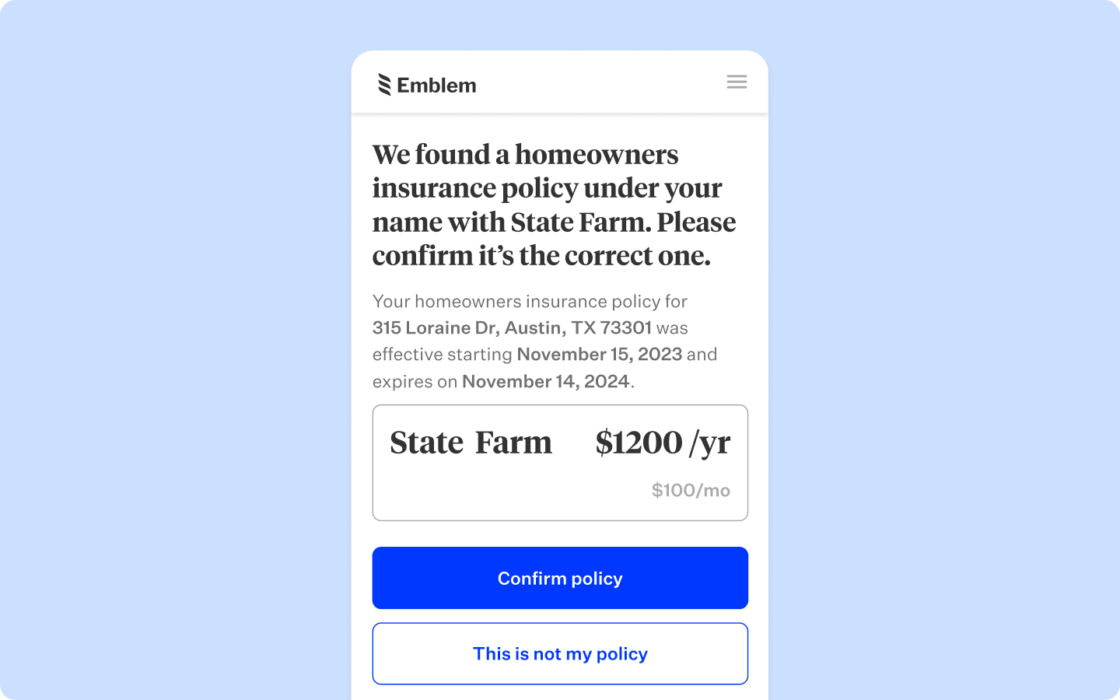

Streamline the pull of insurance information by connecting homeowners directly to their carrier.

Our strategic goal is profitable growth. That means better customer service, increasing volume, and decreasing cost. Blend has been an important part of making that happen.

Mark Shulman

Head of Consumer Lending, BMO Harris Bank

253%

YoY increase in digital home equity applications

5 days

shaved from mortgage and home equity application cycles

15%

YoY growth in overall home equity applications

Sign up for a personalized demo.

We've dismantled the current home equity process. Learn more about our powerful and unique new solution.

Read the article about Shifting home equity into self-driving mode

The home equity landscape has changed. Turn these new challenges into opportunities to capture new borrowers with Blend’s modern home equity strategies.

Start learning about The modern home equity blueprint

Implement a rapid home equity experience for your customers and teams with Blend Instant Home Equity.

Start learning about Home equity under the hood

Subscribe to get Blend news, customer stories, events, and industry insights.