Compass Mortgage

embraces digital transformation with Blend

embraces digital transformation with Blend

Read the full story about Compass Mortgage

Deliver seamless digital journeys from application to close.

Offer unified experience across lines of business.

A single platform powering our products

Elevate the experience of your members

Streamline your lending processes

Optimize workflows and improve lender partnerships

Bring best-in-class home lending experience

Reshaping the way we bank

All press is good press

Powering the future of banking

Better partners for better banking

Join us build something big

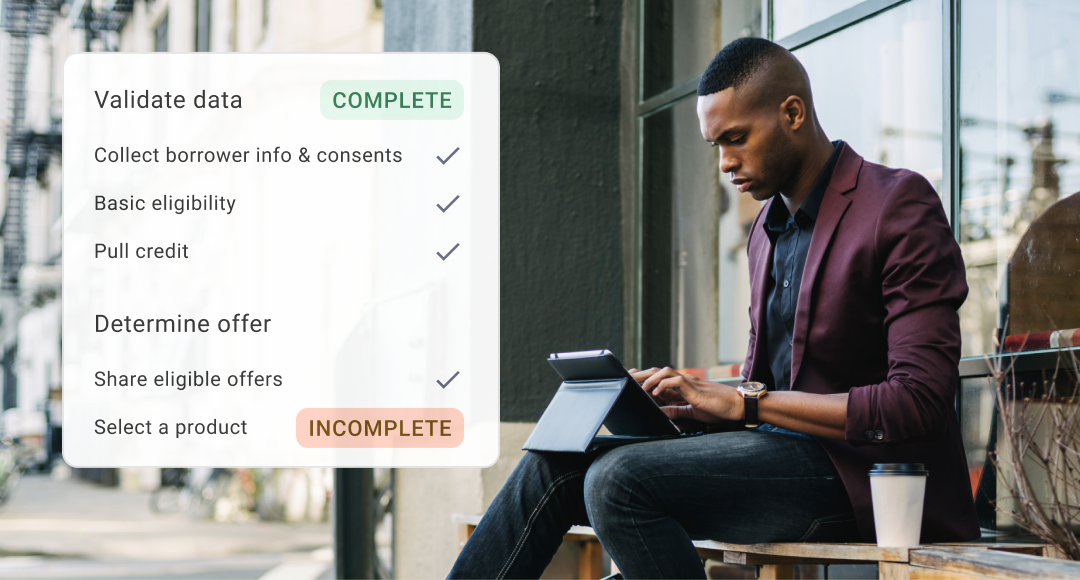

Streamline your process, reduce costs to originate, and close days faster—while delivering the digital-first experience borrowers expect.

Home lending feels like homework to borrowers

Deliver a seamless experience with a clear, intuitive borrower journey from application to close.

Improve your Home Equity pull-through and utilization rates with automated workflows and limited manual touches.

Power an end-to-end digital experience, cut your wet sign package in half, and save on hedging and warehouse costs.

Convert more borrowers, boost engagement and retention, reduce risk of competitive fallout, and scale effortlessly for the next refi boom.

Borrower app with educational, dynamic questioning and self-serve capabilities.

Instant, automated verifications — sourced directly from leading data providers — to speed up the loan lifecycle.

Dedicated mobile app enables your LOs to stay productive from anywhere, 24/7.

Hybrid, hybrid with eNote, and Remote Online Notary options that that flex for your needs.

Blend has been an important part of the profitable growth across our mortgage and home equity lending products.

Mark Shulman

Head of Consumer Lending, BMO Harris Bank

253%

YoY increase in digital home equity applications

5 days

shaved from mortgage and home equity cycles

15%

YoY growth in overall home equity applications

The KeyBank mortgage experience was missing a certain level of client engagement. Blend’s technology gives clients more visibility into their loan application process, but also allows them to communicate with their loan officer as needed.

Ken Raskin

Senior Vice President of Home Lending Sales Experience, Keybank

17 days

improved turn-time

42 point

increase in NPS score

84%

adoption rate from LOs

Meeting customer expectations is a key component of staying competitive in the industry — and the importance of agility in regards to our strategy can’t be overstated.

Kyra Kent

SVP, Director of Digital Origination Strategy, BOK Financial

72%

of the cost of an in-house build

25%

of small business checking and savings volume for the bank

50%

accounts created from new customers

We take care of the heavy lifting so you can focus on helping borrowers achieve homeownership faster.

Subscribe to get Blend news, customer stories, events, and industry insights.

embraces digital transformation with Blend

embraces digital transformation with Blend

Read the full story about Compass Mortgage

Explore the latest tech advancements that can help you engage more borrowers, increase operational efficiency, and maximize closings.

Watch video about Mortgage Power Up: Maximize your tech ROI

Think you know what makes a good technology partner? Think again. See how RBFCU and Blend are forging a winning partnership.

Read the article about RBFCU and Blend partner together now for the future